If you’ve been born and raised in Australia, you would be familiar with the tales of the infamous gold rushes and the “diggers” who worked in these gold fields.

The Australian gold rush began in the nineteenth century. It is something that has become an integral part of the national history. A walk through the pages of the Australian culture and heritage would be incomplete without the chapters on gold.

So, who discovered gold in Australia? Where was it found? And how did we get the Australian gold coins?

When you’re out buying Australian gold coins, seldom does it happen that you make an effort to find out the history behind them. Thankfully for you, we are outlining the entire timeline right here for you!

The Gold Rush

It all began during the early nineteenth century. The colonial settlers had begun settling into the country and with them came the development that laid the foundation for the modernised nation that we are today. The immigrants that came to Australia included shepherds, European pioneers, and explorers.

It was between the 1820 and 1841 that these foreign settlers found gold reserves in the Blue Mountains and the quartz reefs of Australia. However, it was not until Edward Hargraves located gold near Bathurst in New South Wales in 1851 and made a public announcement about that, that all hell broke loose.

There were several other gold discoveries made during the same year and migrants started pouring into the country to get their hands on the gold. The influx of enthusiastic miners was so strong that the colonial authorities had to impose taxes.

The First Gold Coins

What followed was a revolt and the Battle of Eureka Stockade, which once ended, led to the production of Australia’s first ever gold coin. In the year 1854, Sydney became home to the first gold mint in Australia. It was a branch of the Royal Mint – the first one outside of England – opened to produce the very first sovereign coins crafted out of Australian gold.

It’s indeed safe to say that it was the British who introduced the concept of independent gold coins down under.

More Mints More Gold

From there on, Australia never looked back. There were several remarkable discoveries of gold reserves in the country, like the ones at Coolgardie and near Kalgoorlie over the next four decades. In 1872, the Royal Mint opened its second branch in Australia – this time in Melbourne. In 1899, Premier Sir John Forrest succeeded in gaining permission for a third branch of Royal Mint in Perth. By 1957, the Perth Mint had effectively begun refining gold up to 999.999 level of purity as per the standards of the Worshipful Company of Goldsmiths – which soon became a benchmark for all gold sold under the Royal Mint seal.

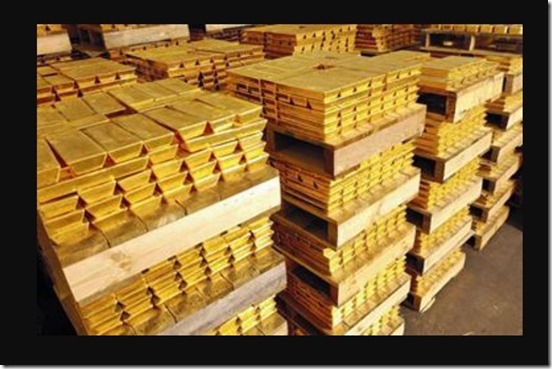

The Official Australian Bullion

In 1976, the Australian Commonwealth removed all restrictions on Australian residents over the buying and selling of gold. It wasn’t until 1985 that the Commonwealth rallied for a sovereign gold bullion coin program to encourage the trade of Australian gold in world markets. The program was eventually launched in 1987.

In case you’re wondering when the iconic Kangaroo design theme was introduced to these gold bullions – it was in the year 1989!