A revs check or vins check used to be free on the government website before, but now they charge you $4 $2 currently for a vins check. This will also depend from state to state. WA, SA, VIC, NSW, ACT, TAS & NT have their own laws around this

The new website for vins check is http://www.ppsr.gov.au/ (direct links below for checking)

Did you know that if you buy a used car with money owing to a financier from a previous owner, it could be repossessed? (check below for more tips on what to look for while buying a motor vehicle)

Everything you need to know about VINS number for vehicles in Australia

- A vehicle identification number is also known as a ‘VIN’ or a ‘Chassis’ number.

- A VIN is the 17-character identifier recorded on most vehicles built after 1988.

- A VIN can only be made up of the following characters: 0-9, A to Z (uppercase) excluding letters I, O and Q.

Before purchasing a used vehicle, you should always do a REVS or VINS check to see if there is any money owing on the vehicle you are buying.

If you type in vins check OR revs check as it is also known, on google or other search engines, you will get many results showing websites available which will do this check. Unfortunately, these websites are only there to make money and will charge a hefty fee compared to the government website as below.

Go Here – Main website

https://transact.ppsr.gov.au/ppsr/Home?li=False

You can either click on Quick vehicle search link on that page or Then here – to quick vin search or search by serial number or then go here >>

https://transact.ppsr.gov.au/ppsr/QuickVINSearch?li=False

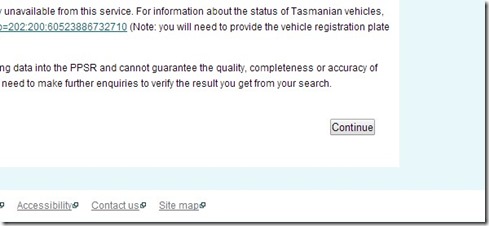

The click the continue button

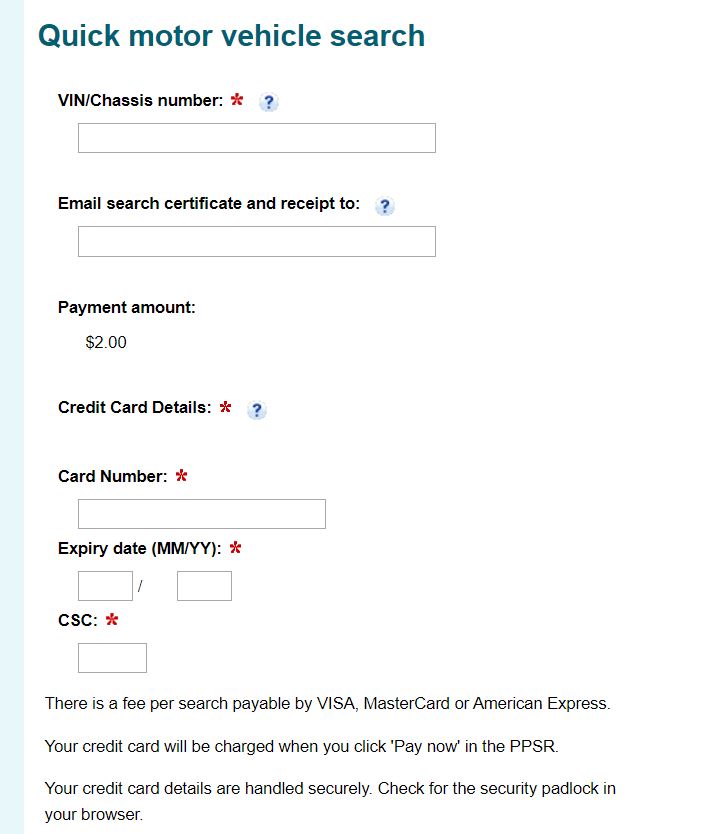

To go here

Enter the vins/chasis number and make payment by credit card and you will get details of the check done in next screen, with a email also sent to your with report and receipt immediately.

You can retrieve the search done as well at a later date if you wish with the search number, they email you.

Here is the rate comparison for a revs or vins check on different websites

Official govt website Vins search –$2

Compared to private agencies below

- www.revscheck.com.au/Australia – $36.95 for a car history report

- www.carhistory.com.au/REVSCheck $36.95 link goes to same website

- http://checkvin.com.au/ – 9.90

After signing transfer papers and Transfer of the Registration

After you purchase the vehicle, you must visit a Motor Registry within 14 days to transfer ownership of the vehicle to your name.

You will need:

- your proof of purchase

- at least two forms of identification

and money to pay the stamp duty and transfer fee

What to look for while buying a motor vehicle

Here are some helpful questions to ask when buying a car, motorcycle, or other vehicle from a private party or dealership:

- Are you the owner of the vehicle? How long have you owned it?

- How has the vehicle been driven? (Around town vs. long trips)

- What major work have you done on the vehicle? Do you have receipts?

- Did you buy the vehicle new?

- Has it ever been wrecked, had body repairs, or been repainted?

- Do you have the title?

What to check for in the vehicle you are buying

- Make sure everything works, including the radio, heater, windshield wipers, lights, and turn signals.

- Check the brakes

- Check the tires — look for good treads and matching tyre rim sizes.

- Check under the hood — look at the battery for leaks, check for dirty oil, check the hoses, etc

Dont get fooled by websites that charge you much more that official rates for the same data and checks , get your checks done by using our links above.

The official website is the Personal property securities register and ti is maintained by the government body Australian Financial Security Authority.