Last year, when Donald Trump was elected president of the United States, the shock waves of this seminal event were felt all the way from the American to the Australian precious metals market.

Initially, the stocks fell steeply all across the board, only to rise up again much higher than before. However, political events notwithstanding, gold price trends in the Australian market are generally expected to remain highly positive in the long term due to many other reasons, such as low global interest rates and stock market fluctuations.

Most market pundits are still optimistic about gold. The funny thing about gold is that it tends to go up in both conditions – whether the markets are shakier, or when they are stable. Since gold is the most valuable thing we have, people like to buy it when they aren’t sure about other investments. The more uncertainty there is in the economic sector as a whole or the political situation in general, the more people would hoard up on gold as the ideal ‘safe bet’ for uncertain times.

On the other hand, brisk economic and industrial growth also portends a rosy outlook for the gold market since a vibrant economy means people would be spending more on gold jewellery as well as investing in the precious metal. This is why double digit gains for this metal are quite possible throughout this year as well as the next one. This is also why gold has almost always been a safe bet – even if the government around you falls and there is no more money, gold will retain its value.

In the light of President Trump’s highly controversial decision regarding immigration from many Muslim countries as well as his threats to pull out from many international economic treaties, there is a certain degree of uncertainty in the global financial environment that makes for a positive gold forecast in Australia.

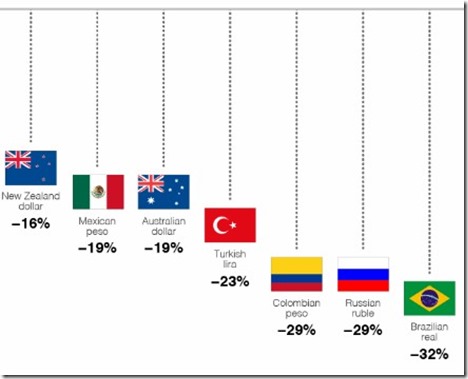

We have before us the example of the Pound Sterling, when the UK decided to exit the European Union. That monumental decision sent the pound sterling crashing downwards in its worst ever one day loss since it had been floated. And as the British people lost confidence in their currency, they increasingly switched to gold in the UK. This had repercussions all over the world, as it led to a bullish gold market. As a matter of fact, the two momentous political events of 2016, i.e. Donald Trump’s ascension to the US presidency as well as ‘Brexit’ enabled gold prices to touch their highest point in 2016, thanks in large part to the volatility in the stock markets all over the world.

In addition to that, there is a small but steady increase of gold usage in the electronic industry, as it is an excellent conductor of electricity and does the job a whole lot better than most other metals.

In the light of the above we can safely state that gold prices are predicted to rise steadily over the coming few years.