Gold as an investment

Gold is the most popular form of investment of all precious metals. It is the preferred investment medium used as a hedge against political, economic or man-made currency crises which include declines in investment markets, inflation, escalating national debt, currency failure, social unrest and war. Like other markets, the gold market is subject to speculation especially because of futures derivatives and contracts.

Various historical factors and current events suggest that gold is more akin to a currency rather than a commodity and analysts says the bullion gold investment might be profitable in the short term due to the global economic outlook

Gold through the ages

Until recently, gold has traditionally been used as money, and has also been the relative standard for currency comparisons relative to countries or economic regions. Gold standards were implemented by many European countries in the latter half of the 19th century. During the financial crises in the wake of World War I these were temporarily held in abeyance. The Bretton Woods system post World War II pegged gold to the United States $ at the rate of US$35 per troy ounce. This practice continued till 1971 when the United State suspended unilaterally direct convertibility of the $ to gold and transitioned to a flat currency system. The Swiss Franc was the last currency to be divorced from gold.

Current factors that impact gold prices

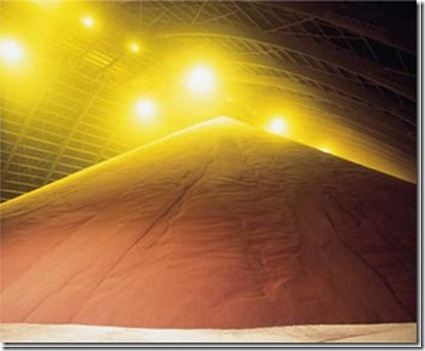

Like most other commodities, bullion gold investment price is determined by supply, demand and speculation. However with gold, unlike other commodities, savings and disposal rather than consumption have a significant role to play in driving the price of gold. Much of the gold mined since inception still exists in bullion or bulk produced jewellery form, and can potentially return to the market when the price is right. The current weak global outlook has also made people invest in gold as a safe bet which has been driving the price of gold

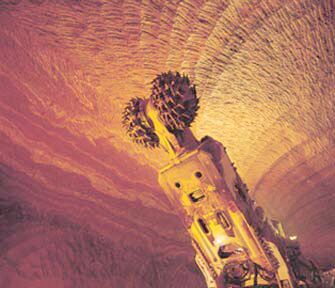

Considering the enormous quantity of gold above-ground in comparison with annual production, price is driven more by sentiment or demand instead of fluctuations in annual production or supply. According to World Gold Council figures, about 2,500 tonnes are mined annually, of which roughly 2,000 tonnes go into jewellery or industrial production/dentistry and only the remainder to exchange traded gold funds and retail investors.

Guest post Written by Ktkoh